27 February 2011

Six Impossible Things

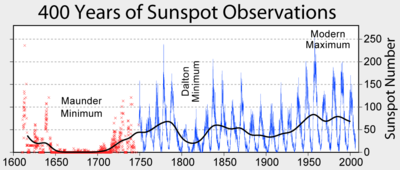

(Source: Glenn Beck...no, sorry, the Solar Influences Data Analysis Center, World Data Center, Royal Observatory of Belgium. The Dalton Minimum featured1816, the Year Without Summer.)

I have been hallucinating with the flu the last few days, and the number of impossible things I would believe before breakfast- if the very idea of breakfast did not cause me to go queasy- is quite remarkable. Dots have been hovering before my eyes, a direct correlation to whatever gawdawful malady has struck me.

Maybe it is karma, I dunno. One thing I know for a fact is that I am not a Democrat and I am not a Republican, and am certainly not from the Tea Party.

What was the first act of the Freshmen in the House who were elected to fix the effects of the deficit that came from the great bi-partisan financial collapse? It was an attempt to redefine the heinous act of rape, in order to reign in abortion clinics. I must be seeing sunspots, no kidding.

I believed one of them yesterday, an apparent correlation between sunspot activity (or the lack of it) that directly affects climate change on the earth.

One of the graphs depicting it is above, and shows the fifty-year period of quiet sun and its coincidental association with the Little Ice Age that wiped out the Viking settlements in North America and sent the wolves pacing across the frozen Thames in England.

In response, I got a blast back from a dear friend, who is of the anthropomorphic school of climate change, which holds that man-made release of carbon dioxide is what is actually causing climate change.

Since the popular models- including the discredited hockey stick graph of immediate doom- do not appear to include the effects of the most significant burning nuclear fireball in our sky, the one that actually fries our unprotected skins, I am just saying, you know, there might be more to this.

I don’t like pollution, and I don’t like the rapacious exploitation of our precious environment. But just for the record, China and India are both scheduled to surpass the US Economy in total GDP by as soon as 2020 and 2040, respectively, and the idea that they are not going to be deploying coal-fired power plants is…well, you know. Impossible.

I will table that one for now. I always get in trouble when I talk about two subjects: illegal immigration or climate change, so I will leave it at that.

For now, though, here is a candidate list of other possible impossible things to believe this morning. It is by no means exclusive, and I am sure you have your own.

2. We are not going to die, and if we only live and eat better we will not get infirm and senile and be robbed of our dignity like Raven and Magpie. Susan Jacoby’s fine book “Never Say Die,” addresses this impossibility. Jacoby argues that American Boomers have a collective blind-spot on the “Old Old,” or those over 85 like my folks. Boomers are encouraged to believe life can be reinvented after 60 just as we reinvented the teen culture and Preppiedom. We think our later years will be filled with vigor, work and that medical science will spare us all from decrepitude. Forgettabouddit. Even if it could, only the people at Goldman Sachs will be able to afford it.

3. The link between autism and childhood immunizations was a tabloid phenomenon. It was originally (though less spectacularly) endorsed not by The Daily Mail but by that other noted British political broadsheet The Lancet, which took two decades to retreat and denounce the bogus science contained in the paper that linked childhood vaccines to the scourge of autism. The perpetrator of that hoax should be in jail- it was a conflict of interest in which he attempted to peddle a drug in which he had a non-disclosed proprietary interest. If there is a common theme linking #1 and #3, it is that science has now become a key driver for social policy, and I defy anyone to say that the going-in assumptions in any examination do not help drive the outcomes.

I forget- are eggs and coffee good or bad this week?

4. That Goldman-Sachs is looking out for their investors and their nation. Now left with significantly less competition thanks to their cozy ties to regulators, they have changed their predatory spots and will not rapaciously screw us all again. I read this morning that the Dow, which has been doing remarkably well, is about a third higher than any reasonable investor should expect. It is another bubble.

5. That there is no inflation, since food (record highs) and oil (most of the way back to record), and other commodities like copper, rare earths, silver and gold should not be included in the CPI, since those massive components of discretionary family spending will somehow skew "the true rate of inflation." We are entering a Stagflation period, I fear, and I did not like it last time. What about you?

6. Mr. Bernanke’s Quantitative Easing, being managed under the radar for most of us, will help stimulate the economy. The central bank has previously targeted an extremely low rate of interest, near or at zero percent. We are at the end of that road. Hence, the Fed is trying something the Japanese tried when their bubble burst. Here is how it works:

The central bank credits its own bank account with money it creates electronically.

The central bank buys government bonds (including long-term government bonds) or other financial assets, from commercial banks or other financial institutions, with the newly created money.

Oh, the encyclopedias describe this something-from-nothing process as a “last resort” for a Central Bank.

I mean, it is not impossible it could work. I am just saying that the people doing it don’t have much of a track record for success, you know?

Copyright 2011 Vic Socotra

vicsocotra.com | Subscribe to the RSS feed!