Things That Soar

A note today that is briefer than Marlow’s tome yesterday morning about things we might remember as we stumble on towards the distant light. This one featured the strange tranquility of the heavens and the lure of public lucre.

You can see that above. Sometimes there are nearly thirty of these big creatures, either perched on the property or soaring above it in that hypnotic effortless flight. Only one of them was here this morning, and effortless high above the south pasture. That bird is a curious companion to those of us who live below the graceful wings, sometimes shadowed by them briefly as it intersects the light from our distant but jolly Sun. And ugly as sin, up close. We came to an accommodation on that matter with the discharge of a pistol. Not pointed in a harmful direction, of course, but with a forthright declaration that perching on the rail of the porch and gazing through the window was a bridge too far in our farm version of “intersectionality.”

There are those who characterize the nature of the soaring wonder an omen. “Buzzard” is an uncharitable bit of nomenclature. We just think of them as what they are: masterworks of function and design, and an inspiration for conversion of the earth’s motion to lively, alert and effortless freedom. Which would be useful these days for many of us.

We could go into that, but it would take a moment. We could marvel at the nonsense they have packed into the colossus of legislation pending in the Senate. A pal sent along a diagram of what we have spent as a nation that did its own version of the Buzzard’s impressive flight. The trillions of dollars in the debt we all owe, courtesy of our servants in Washington was represented as aircraft carriers constructed of gold, at current market rates.

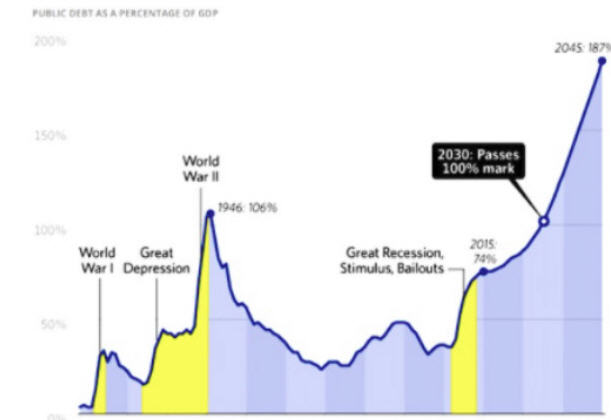

There were five of them, if you can imagine. And for those who walked their steel decks and labored in their tiny spaces within the vastness of their bulk, the idea of five of them, all in muted golden magnificence is enough to give one a start. Here is a quick look at our public obligation, with the general causes annotated. They were big things. The impact of the two World Wars are obvious. The increase due to the Great Depression is a bit of an oxymoron, but shoveling money at real trouble is a generally accepted means for getting through it. You will note that the Debt is calculated in this depiction as a percentage of Gross National Product, an annual accounting of everything that we do as a nation. All of us. For a year’s ride around the Sun.

The funds obligated to pay for the events is already on the books, along with the interest required to compensate those who are prepared to share a general sense that things will continue in some order, that funds borrowed will be repaid as agreed. But you will note the yellow highlights of events. Those are times when crisis is met with extraordinary need and repaid the way many of us do with our credit cards. To meet crisis, there is required sacrifice.

Winning a global conflict was a big deal, but you can see the comparison with today’s carefree borrowing. As you will also note, there is no crisis in the spectacular rise in recent debt, the credit charges that followed the unpleasant recession that followed the Recession of 2008. That debt bubble was created, according to some, by the Government’s insistence that housing loans did not require borrowers to provide reasonable evidence that mortgages would be repaid as agreed.

You may recall that intoxicating time- the one where the server at your favorite watering hole might be flipping houses on the market, carefree, and theoretical owner of a few homes until one of those yellow vertical lines came crashing down. Splash, for example, lost a hundred grand one week, and has adapted to living by the fence here at The Farm. He doesn’t mind, but no longer has a family to support.

That was something that could not go on, and the failure of the imposed lending standards cost a lot of us a bit of cash. You will see that prior to the collapse, we had a significant but apparently manageable debt approaching a third of our GDP. That spiked to nearly three quarters by 2015, and there is no indication of any inclination to return to a lower level of borrowing. The debt currently stands at nearly thirty trillion dollars, or the weight of the five golden aircraft carriers. It is anticipated by those wise people at the Federal Reserve that current and proposed additions to the debt will continue to increase to nearly twice our GDP by 2045, with the prospect of the failure of popular programs like Social Security and Medicare along the way only ten years distant.

Many of us at the Farm anticipate escaping the burden by timely death. That is an unusual factor in budget planning- at least the relief part- but since there is no “yellow” in the years to come, this projection can anticipate additional external stress, some of it induced by the weight of the debt itself.

The people who have created this depiction may anticipate life expectancies exceeding 2045. We do not. We are just a little concerned about where the next yellow line is going to fall. The one that seems sort of inevitable. We are hoping for something later than 2040, at least. Perhaps we can soar above the next trouble. The lines seem to have no problem at all going up. The question is when the yellow line will come crashing down. We may be a bit cynical about the mater, but we have been to the show before and are inclined to think it will be sooner, rather than later.

Copyright 2021 Vic Socotra

www.vicsocotra.com